How to Apply for Financial Aid Along with Your Scholarship

Securing a scholarship is a fantastic achievement, but often it doesn't cover all college expenses. Many students find they still need additional financial assistance to make their educational dreams a reality. This is where financial aid comes in. Learning how to apply for financial aid alongside your scholarship can significantly ease the financial burden of higher education. This article will guide you through the process, explaining eligibility requirements, necessary documentation, and strategic tips for maximizing your aid package. We'll explore key resources and demystify the application process, empowering you to navigate the world of financial aid with confidence.

How to Apply for Financial Aid Alongside Your Scholarship

Applying for financial aid even when you have a scholarship is a smart move, as it can significantly reduce your overall college expenses. Scholarships often don't cover the entire cost of attendance, which includes tuition, fees, room and board, books, and other expenses. Financial aid, such as grants and loans, can help bridge this gap. The key is to understand the application processes for both scholarships and financial aid and how they interact. By applying for both, you maximize your chances of receiving enough funding to cover your educational costs, allowing you to focus on your studies instead of worrying excessively about money. Remember, financial aid eligibility is often determined by your family's financial situation, regardless of whether you have a scholarship. Therefore, it's crucial to complete the necessary applications, such as the FAFSA, to determine your eligibility for additional aid.

Understanding Your Scholarship Terms

Before applying for financial aid, carefully review the terms of your scholarship. Some scholarships are "need-based," meaning they will reduce their award amount if you receive other forms of financial aid. Others are "non-need-based," and they won't be affected by any additional aid you receive. Knowing this distinction is crucial for planning your finances and understanding how much additional aid you might need. Also, check if your scholarship has any restrictions on using the funds for specific expenses like tuition only.

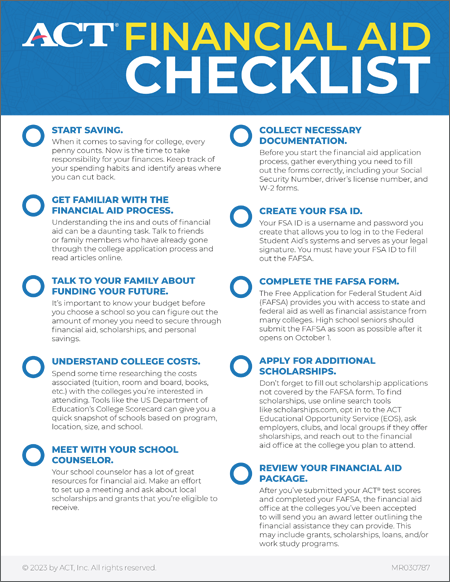

Completing the FAFSA (Free Application for Federal Student Aid)

The FAFSA is the cornerstone of the financial aid application process. Completing the FAFSA is essential, even if you have a scholarship. This application determines your eligibility for federal grants, loans, and work-study programs. The information you provide on the FAFSA is used to calculate your Expected Family Contribution (EFC), which helps colleges determine your financial need. Remember to submit the FAFSA as early as possible after it opens on October 1st each year, as some aid programs have limited funding.

Applying for Institutional Aid

In addition to federal aid, many colleges and universities offer their own institutional financial aid programs. These programs can include grants, scholarships, and loans funded by the institution itself. Check the financial aid website of the college you plan to attend for specific requirements and deadlines for institutional aid. Often, you'll need to complete a separate application form, such as the CSS Profile, to be considered for institutional aid. Ensure you meet all the eligibility criteria and submit your application on time.

Contacting the Financial Aid Office

The financial aid office at your college or university is a valuable resource for navigating the financial aid process. Don't hesitate to contact them with any questions or concerns you may have. They can provide clarification on your financial aid award, explain the terms of your loans, and help you understand your options for covering any remaining expenses. Building a relationship with the financial aid office can be beneficial throughout your college career.

Exploring Private Loans and Other Resources

If you still have unmet financial needs after exhausting all other options, consider exploring private student loans. However, exercise caution when taking out private loans, as they often come with higher interest rates and less flexible repayment terms than federal loans. Research different lenders, compare interest rates and repayment plans, and only borrow what you absolutely need. Other resources, such as crowdfunding platforms and part-time jobs, can also help you cover college expenses.

| Financial Aid Type | Description | Impact on Scholarship |

|---|---|---|

| Federal Grants (e.g., Pell Grant) | Need-based grants from the federal government. | May reduce need-based scholarships; usually doesn't affect merit-based scholarships. |

| Federal Loans (e.g., Stafford Loan) | Loans from the federal government with repayment options. | Generally, doesn't affect scholarship amount. |

| Institutional Grants | Grants from the college/university. | May reduce need-based scholarships; depends on the institution's policies. |

| Private Loans | Loans from private lenders (banks, credit unions). | Generally, doesn't affect scholarship amount. |

| Work-Study | Part-time jobs provided by the college. | Doesn't affect scholarship amount; provides income for expenses. |

https://youtube.com/watch?v=8MHWR7D3W5M%26pp%3DygUPI3VrZ3NjaG9sYXJzaGlw

Can I get financial aid and scholarships?

Understanding Financial Aid Eligibility

- Financial Need: This is a primary factor. Financial aid offices assess your family's ability to contribute to your education based on income, assets, and other factors reported on forms like the FAFSA (Free Application for Federal Student Aid) in the United States. Other countries will have their own equivalent systems.

- Academic Merit: Some scholarships are awarded based on academic achievement, such as GPA, test scores, or class rank. These merit-based scholarships may be offered directly by colleges or by external organizations.

- Demographic Factors: Scholarships and aid programs often consider factors like ethnicity, gender, religion, and field of study. Many organizations offer scholarships specifically for students from underrepresented groups or those pursuing certain career paths.

Types of Financial Aid Available

- Grants: These are typically need-based and do not need to be repaid. Examples include the Federal Pell Grant in the United States, which is awarded to undergraduate students with exceptional financial need.

- Loans: These need to be repaid with interest. Federal student loans often have lower interest rates and more flexible repayment options compared to private loans. However, borrowing should be carefully considered to avoid excessive debt.

- Work-Study: This program allows students to earn money for college expenses by working part-time jobs, often on campus. It's available to students who demonstrate financial need.

Finding Scholarships: Where to Look

- College Websites: Check the financial aid or scholarship section of the colleges you're interested in. Many colleges offer their own institutional scholarships to attract talented students.

- Online Scholarship Databases: Websites like Scholarships.com, Fastweb, and the College Board’s BigFuture provide searchable databases of thousands of scholarships from various sources.

- Local Organizations: Contact local businesses, community groups, religious organizations, and professional associations in your area. They may offer scholarships to local students.

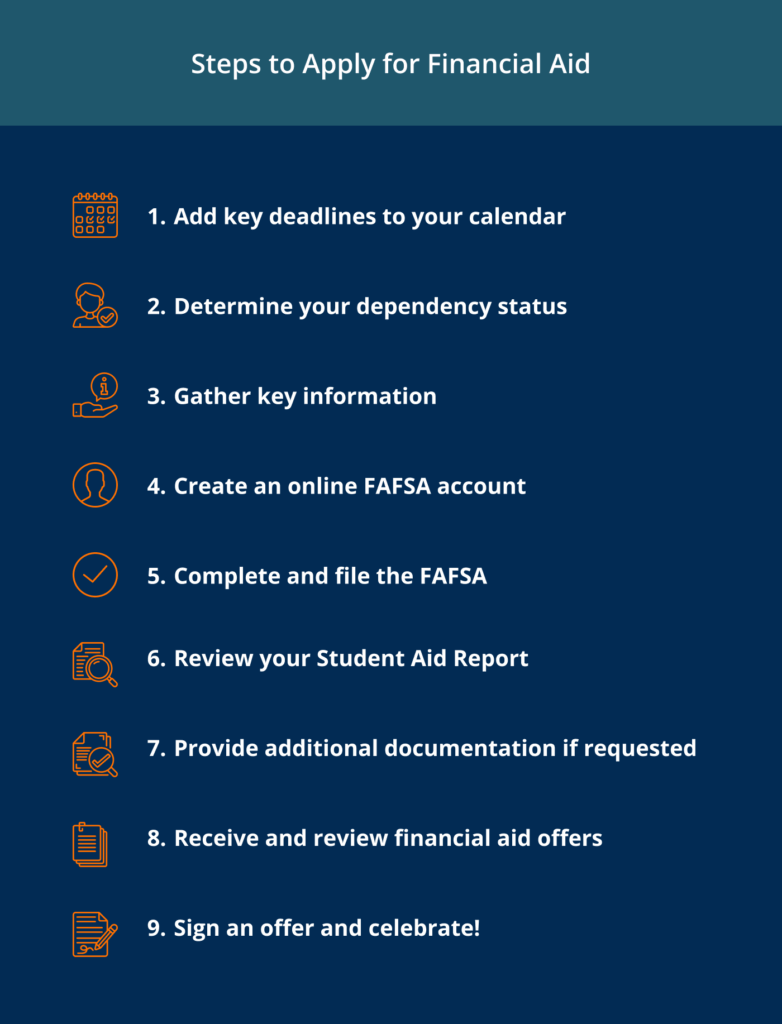

The Application Process: Key Steps

- Complete the FAFSA (or Equivalent): This is often the first step in applying for financial aid in the United States. It determines your eligibility for federal and state aid, as well as many institutional scholarships. Check your country's equivalent process.

- Research Scholarship Requirements: Carefully review the eligibility criteria, application deadlines, and required materials for each scholarship you're interested in. Pay attention to essay prompts and other application components.

- Submit Applications Early: Start the application process as early as possible, as many scholarships have deadlines well in advance of the academic year. This gives you ample time to gather all necessary documents and prepare a strong application.

Maximizing Your Chances of Success

- Maintain Good Grades: Academic performance is a significant factor in many scholarship decisions. Strive to maintain a strong GPA and excel in your coursework.

- Get Involved in Extracurricular Activities: Participation in clubs, sports, volunteer work, and other activities can demonstrate your leadership skills, commitment, and interests, making you a more attractive scholarship candidate.

- Write Compelling Essays: Scholarship essays are your opportunity to showcase your personality, experiences, and goals. Craft well-written and thoughtful essays that highlight your strengths and why you deserve the scholarship.

Can you get financial aid and a scholarship at the same time?

The Relationship Between Financial Aid and Scholarships

It's important to understand how these two types of funding interact. Here's a breakdown:

- Need-Based vs. Merit-Based: Financial aid programs like the Federal Pell Grant are primarily based on your family's financial need, as determined by the Free Application for Federal Student Aid (FAFSA). Scholarships, on the other hand, are often based on academic achievement, extracurricular activities, or specific talents. This fundamental difference means they can be awarded independently of each other.

- Filling the Gaps: Often, scholarships are used to fill the gap between the cost of attendance and what financial aid covers. For example, if your financial aid package covers 70% of your tuition and fees, a scholarship can help cover the remaining 30% or reduce the amount you need to borrow in student loans.

- Institutional Policies Vary: While it's generally possible to receive both, some institutions have specific policies about how scholarships impact financial aid. For instance, they might reduce the amount of institutional grants or loans if you receive a significant amount in scholarships. Always check with the financial aid office at your chosen school to understand their specific rules.

How to Maximize Your Aid and Scholarship Potential

To increase your chances of receiving both financial aid and scholarships:

- Complete the FAFSA Early: The FAFSA is the gateway to federal financial aid, and many institutions use it to determine eligibility for their own grants and scholarships. Submitting it early increases your chances of receiving the maximum amount of aid available.

- Apply for Numerous Scholarships: Don't limit yourself to just a few scholarships. Cast a wide net and apply for as many scholarships as you're eligible for, even if the award amounts are small. Every little bit helps!

- Research Institutional Aid and Scholarships: Explore the scholarships and grants offered directly by the colleges you're applying to. These are often less competitive than national scholarships.

Understanding "Stacking" and Potential Limitations

While "stacking" financial aid and scholarships is common, there are limits to consider:

- Cost of Attendance Limit: The total amount of financial aid and scholarships you receive cannot exceed the cost of attendance (COA) at your institution. The COA includes tuition, fees, room and board, books, supplies, and other related expenses.

- Potential Impact on Need-Based Aid: Receiving large scholarships can sometimes reduce your eligibility for need-based financial aid. The financial aid office will typically adjust your aid package to account for the scholarship funds.

- Reporting Requirements: You are required to report all scholarships you receive to your financial aid office. Failure to do so could result in adjustments to your aid package or even the loss of financial aid eligibility.

Managing Your Financial Aid and Scholarship Awards

Proper management is crucial:

- Communicate with the Financial Aid Office: Regularly communicate with the financial aid office at your school to understand how your scholarships are affecting your financial aid package.

- Track Your Awards: Keep a record of all the scholarships you receive, including the award amounts and any conditions attached to the scholarships.

- Consider Scholarship Renewal Requirements: Some scholarships require you to maintain a certain GPA or fulfill other requirements to maintain eligibility for renewal. Make sure you understand and meet these requirements.

Common Scenarios and Examples

Here are a couple of common scenarios:

- Scenario 1: Pell Grant Recipient with a Scholarship: A student receives a Pell Grant based on their EFC (Expected Family Contribution) and also earns a merit-based scholarship from a local organization. The scholarship helps cover the remaining cost of tuition and fees that the Pell Grant doesn't cover.

- Scenario 2: Middle-Income Student with Multiple Scholarships: A student from a middle-income family doesn't qualify for need-based aid but applies for and receives several small scholarships. These scholarships, combined, help reduce the amount of student loans they need to take out.

- Scenario 3: Scholarship Impacts Institutional Grant: A student receives a large, outside scholarship. The university reduces the amount of the university's grant by the amount of the scholarship, because the grant was provided to the student to enable to attend.

Do scholarships interfere with financial aid?

Scholarships and Need-Based Aid Reduction

When you receive a scholarship, the financial aid office typically reduces other need-based aid to compensate. This is because the total amount of aid you receive (including scholarships) cannot exceed the cost of attendance. Often, grants are the first type of aid to be reduced, as they are also need-based and considered "free money." Loan amounts might also be reduced, but this is less common as loans are generally preferred by students over having grant aid cut. The order in which aid is reduced can vary by institution.

- Grants are usually reduced first, as they are considered need-based aid.

- Loan amounts may be reduced, but less frequently than grants.

- Work-study opportunities could potentially be affected, depending on the institution's policy.

Impact on Merit-Based Aid vs. Need-Based Aid

The impact of scholarships differs depending on whether the existing financial aid is merit-based or need-based. If your initial aid package included merit-based scholarships from the institution, the effect of outside scholarships might be less pronounced. However, need-based grants and loans are more likely to be adjusted downwards. Institutional policies vary widely, so it is crucial to understand how your specific college handles outside scholarships in relation to their own aid offerings.

- Merit-based aid may be less affected by outside scholarships.

- Need-based grants and loans are more likely to be reduced.

- Check the college's policy regarding outside scholarships.

Scholarship Displacement and Institutional Policies

Some institutions practice "scholarship displacement," meaning they reduce their own aid dollar-for-dollar by the amount of the outside scholarship. However, many institutions are moving away from this practice. It is essential to understand the specific policies of each institution you are considering. Contact the financial aid office directly to clarify how outside scholarships will impact your financial aid package. Knowing this policy before accepting a scholarship can help you make informed decisions about where to attend college.

- "Scholarship displacement" is the reduction of institutional aid by the amount of the outside scholarship.

- Institutional policies vary widely regarding outside scholarships.

- Contact the financial aid office for clarification on their policy.

Understanding the Cost of Attendance (COA)

The Cost of Attendance (COA) is a key factor. It includes tuition, fees, room and board, books, and other expenses. Your total financial aid package, including scholarships, cannot exceed the COA. If it does, the financial aid office must reduce some form of aid. Understanding your COA and how it is calculated is crucial for assessing the impact of scholarships on your financial aid package. The COA is the ceiling for all types of aid combined.

- COA includes tuition, fees, room and board, books, and other expenses.

- Total aid cannot exceed the COA.

- Understanding your COA is crucial for assessing the impact of scholarships.

Reporting Scholarships to the Financial Aid Office

It is imperative to report all scholarships you receive to the financial aid office. Failing to do so can result in discrepancies and potential issues with your financial aid. The financial aid office needs accurate information to adjust your aid package appropriately and ensure compliance with federal regulations. Furthermore, transparency helps avoid future problems and ensures that your financial aid package is correctly adjusted according to institutional policy.

- Report all scholarships to the financial aid office.

- Failure to report can cause discrepancies.

- Transparency helps avoid future problems.

Do I need to fill out FAFSA if I have a scholarship?

Understanding Your Total Cost of Attendance

Even if a scholarship covers a significant portion of your tuition, it likely doesn't cover all your college expenses. The FAFSA helps the school determine your Expected Family Contribution (EFC) or Student Aid Index (SAI), which is used to calculate your financial need. This need is then used to determine other aid eligibility.

- Tuition and fees

- Room and board

- Books and supplies

- Transportation

- Personal expenses

Unlocking Other Forms of Financial Aid

The FAFSA is not just for federal student loans. It also unlocks access to grants, work-study programs, and even some state and institutional aid. Even if you don't think you'll qualify for need-based aid, it's always best to apply to see what you might be eligible for.

- Federal Pell Grants

- Federal Supplemental Educational Opportunity Grants (FSEOG)

- State grants

- Institutional grants

- Work-study programs

Scholarship Requirements and Reporting

Many scholarships require you to file the FAFSA as part of their eligibility criteria. This is often because scholarships are designed to supplement other forms of financial aid, not replace them entirely. The FAFSA provides the scholarship provider with a comprehensive overview of your financial situation.

- Ensuring you meet the scholarship's financial requirements

- Confirming your enrollment status

- Providing necessary information for scholarship disbursement

The FAFSA as a Baseline for Financial Aid Evaluation

The FAFSA serves as a baseline for most colleges' financial aid packages. Even if you have a full-ride scholarship that covers tuition and fees, the school may still use the FAFSA to determine if you qualify for additional aid to help with living expenses or other educational costs. The FAFSA helps colleges create a comprehensive aid package that addresses your overall financial needs.

- Determining your eligibility for institutional grants and scholarships

- Calculating your eligibility for work-study programs

- Assessing your eligibility for student loans, even if you don't intend to borrow

Unexpected Changes in Financial Circumstances

Life happens, and your financial situation can change unexpectedly. Filing the FAFSA annually ensures that you're eligible for aid if your financial circumstances worsen during your college career. For example, if a parent loses their job or experiences a significant medical expense, you may become eligible for need-based aid that you weren't eligible for before.

- Job loss or reduction in income

- Unexpected medical expenses

- Changes in family size or marital status

Frequently asked questions

How does applying for financial aid impact my scholarship?

Applying for financial aid, such as federal grants or loans, can affect your scholarship in various ways. Some scholarships are need-based and may be reduced or eliminated if your financial aid covers a significant portion of your educational expenses. Other scholarships are merit-based and are unaffected by your financial aid package. Always review the terms and conditions of your scholarship to understand how financial aid might influence its award amount.

Can I apply for financial aid even if I already have a scholarship?

Yes, you can and often should apply for financial aid even if you already have a scholarship. Scholarships may not cover all of your college expenses, such as room and board, books, and fees. By completing the FAFSA (Free Application for Federal Student Aid), you can determine your eligibility for federal and state aid, including grants, loans, and work-study programs, which can help fill any financial gaps remaining after your scholarship is applied.

What documents do I need to apply for financial aid in addition to my scholarship application?

To apply for financial aid in addition to your scholarship application, you will typically need to complete the Free Application for Federal Student Aid (FAFSA). This requires providing information about your income, assets, and family size. You may also need tax returns, bank statements, and W-2 forms for both you and your parents, if you are a dependent student. Specific documentation may vary depending on the state and institution, so it's crucial to check with the financial aid office.

Will receiving financial aid reduce the amount of my scholarship?

Whether receiving financial aid reduces the amount of your scholarship depends on the specific terms of your scholarship and the policies of the institution. Some scholarships have policies that reduce the award amount if you receive other forms of aid, while others do not. It is essential to carefully review the scholarship agreement and contact the scholarship provider or the college's financial aid office for clarification on how financial aid will affect your scholarship.