How to Navigate Both Scholarships and FAFSA for Maximum Aid

Securing financial aid for college can feel like navigating a complex maze. Many students rely on a combination of scholarships and the Free Application for Federal Student Aid (FAFSA) to make their dreams of higher education a reality. But understanding how these two crucial resources interact and complement each other is key to maximizing your aid package. This article breaks down the process of effectively applying for both scholarships and FAFSA, providing practical tips and strategies to help you unlock the maximum financial assistance available and minimize your out-of-pocket expenses. Learn how to strategically approach both avenues to fund your education.

How to Maximize College Funding: Navigating Scholarships and FAFSA

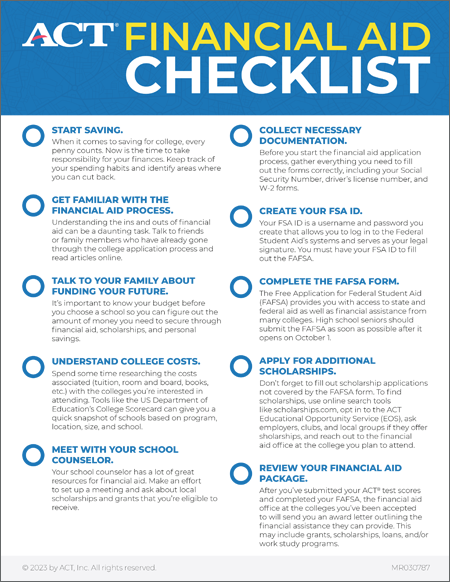

To secure the maximum financial aid for college, a strategic approach that combines scholarship applications and the Free Application for Federal Student Aid (FAFSA) is essential. FAFSA unlocks eligibility for federal grants, loans, and work-study programs, while scholarships provide "free money" that doesn't need to be repaid. Mastering both pathways involves understanding eligibility requirements, deadlines, and application processes. A proactive and organized approach significantly increases your chances of minimizing the financial burden of higher education. Successfully managing both FAFSA and scholarships can make college more affordable and accessible.

Understanding the FAFSA and its Impact

The FAFSA, or Free Application for Federal Student Aid, is the gateway to most federal, state, and institutional financial aid. It collects information about your family's income and assets to determine your Expected Family Contribution (EFC), which colleges use to calculate your financial need. The lower your EFC, the more financial aid you're likely to receive. Completing the FAFSA accurately and on time is crucial, as many aid programs have limited funding and are awarded on a first-come, first-served basis. It is a critical first step toward securing financial assistance for college.

Finding and Applying for Scholarships

Scholarships come in various forms, from merit-based awards recognizing academic achievement to need-based scholarships assisting students with financial hardship. Start your scholarship search early and utilize online databases like Fastweb, Scholarship America, and Sallie Mae's Scholarship Search. Focus on scholarships that align with your interests, skills, and background to increase your chances of success. Remember to tailor your applications to each scholarship's specific requirements and highlight your unique qualifications and experiences to make a compelling case.

Strategic Timing: FAFSA vs. Scholarship Deadlines

FAFSA opens annually on October 1st, and it's advisable to complete it as soon as possible. Many states and colleges have their own FAFSA deadlines, so be sure to check these deadlines and prioritize accordingly. Scholarship deadlines vary greatly, with some occurring throughout the year. Create a calendar to track all relevant deadlines and allocate sufficient time to prepare each application. By managing deadlines effectively, you ensure you're considered for all available aid opportunities.

Maximizing Aid through Appeals and Negotiations

If your family's financial situation changes significantly after submitting the FAFSA, such as due to job loss or unexpected medical expenses, you can appeal to the college's financial aid office. Provide supporting documentation to explain your circumstances and request a re-evaluation of your financial aid package. You can also negotiate with colleges to improve your aid offers, especially if you receive better offers from competing institutions. Showing genuine interest in attending the college and demonstrating your financial need can strengthen your negotiation position.

Keeping Track of Awards and Avoiding Scams

Once you receive financial aid offers, carefully compare them to understand the terms and conditions of each award. Pay attention to the types of aid offered (grants, loans, work-study) and the repayment obligations associated with loans. Be wary of scholarship scams that require you to pay a fee to apply or guarantee you'll receive an award. Legitimate scholarships are free to apply for. Meticulous record-keeping and a critical eye are essential for navigating the financial aid process safely and effectively.

| Key Area | Action Steps | Importance |

|---|---|---|

| FAFSA Completion | Submit FAFSA by deadlines, accurately reporting financial information. | Essential for accessing federal, state, and institutional aid. |

| Scholarship Search | Identify and apply for scholarships matching your qualifications. | Reduces reliance on loans and provides "free money." |

| Deadline Management | Track FAFSA and scholarship deadlines to avoid missing opportunities. | Ensures you're considered for all available aid. |

| Appeals and Negotiations | Appeal to colleges for more aid if your financial situation changes. | Can improve your financial aid package. |

| Award Review | Compare financial aid offers and understand terms and conditions. | Allows you to make informed decisions about financing college. |

Can you get a scholarship and FAFSA at the same time?

Here's your detailed answer, without any greetings or conclusions:

Yes, you can definitely get a scholarship and FAFSA (Free Application for Federal Student Aid) at the same time. In fact, it's a very common and encouraged practice. FAFSA determines your eligibility for federal student aid, which includes grants, loans, and work-study programs. Scholarships, on the other hand, are merit-based or need-based awards that don't need to be repaid. Receiving a scholarship can actually help you reduce the amount of federal aid you need, especially student loans.

How FAFSA and Scholarships Interact

Understanding the interplay between FAFSA and scholarships is crucial. FAFSA assesses your family's financial situation to determine your Expected Family Contribution (EFC). This EFC, along with the cost of attendance at your chosen school, is used to calculate your financial need. Scholarships can reduce your unmet need, potentially decreasing the amount of loans you need to borrow. Here's a breakdown:

- FAFSA calculates your Expected Family Contribution (EFC). This is an estimate of how much your family can contribute towards your education.

- Your financial need is determined by subtracting your EFC from the Cost of Attendance (COA) at your school. (Financial Need = COA - EFC)

- Scholarships reduce your unmet need. This can lessen the amount of loans you need to take out.

Reporting Scholarships to Your School

It's essential to report any scholarships you receive to your school's financial aid office. They need to know about all your financial resources to properly package your aid. Failing to report scholarships could lead to adjustments in your financial aid package. Here's what you should consider:

- Always inform your school's financial aid office about any scholarships you receive. This ensures accurate aid packaging.

- The financial aid office may adjust your aid package to account for the scholarship. This could involve reducing loan amounts or other forms of aid.

- Understand how the scholarship will impact your overall financial aid package. Ask your financial aid officer for clarification if needed.

Prioritizing Scholarships and Grants

The ideal scenario is to use scholarships and grants first to cover your educational expenses. These are essentially "free money" and don't need to be repaid. Utilizing these resources before tapping into loans is a smart financial strategy. It allows you to graduate with less debt. Consider these points:

- Prioritize using scholarships and grants before considering student loans. This will minimize your debt burden after graduation.

- Explore all available scholarship opportunities. Many scholarships go unclaimed each year.

- Look for scholarships specifically tailored to your field of study, background, or interests. These are often less competitive.

Potential Impact on FAFSA Aid

While scholarships are beneficial, they can potentially impact the amount of need-based aid you receive through FAFSA. The financial aid office will consider the scholarship amount when determining your eligibility for grants, work-study, and subsidized loans. However, the overall impact is usually positive, as it reduces your overall financial burden. Be aware of the following:

- Receiving a large scholarship might reduce the amount of need-based aid you are eligible for. This is because your financial need is reduced.

- The financial aid office will consider the scholarship amount when determining your aid package. This is standard procedure.

- Despite potential adjustments, the net result is usually more financial assistance overall. Scholarships help to bridge the gap between your financial resources and the cost of education.

Where to Find Scholarship Opportunities

Numerous resources are available to help you find scholarship opportunities. Online databases, your school's financial aid office, and community organizations are excellent places to start your search. Persistence and diligent research are key to uncovering valuable scholarships. Remember these resources:

- Explore online scholarship databases such as Fastweb, Scholarships.com, and Sallie Mae. These databases allow you to search for scholarships based on your criteria.

- Contact your high school or college's financial aid office for information on local and institutional scholarships. They often have listings of scholarships specific to their students.

- Check with community organizations, religious groups, and professional associations for scholarship opportunities. Many organizations offer scholarships to students pursuing specific fields or meeting certain criteria.

How can I maximize my financial aid eligibility?

Understanding the FAFSA and CSS Profile

The Free Application for Federal Student Aid (FAFSA) is the key to unlocking federal financial aid, and the CSS Profile opens doors to aid from many private institutions. Completing these forms accurately and on time is crucial.

- Meet Deadlines: Both the FAFSA and CSS Profile have specific deadlines. Missing these deadlines can significantly reduce your chances of receiving aid.

- Accuracy is Key: Provide accurate information on both forms. Any discrepancies can delay your application or even lead to ineligibility.

- Understand the Questions: If you are unsure about how to answer a question, seek clarification from the financial aid office or a trusted advisor. Do not guess.

Optimizing Your Asset and Income Reporting

How you report your assets and income can significantly impact your Expected Family Contribution (EFC), which directly affects the amount of financial aid you receive.

- Understand Reportable Assets: Certain assets are considered more heavily than others in the EFC calculation. Focus on understanding which assets are reportable and how they impact your aid eligibility.

- Minimize Reportable Assets (Legally): Where legally permissible and financially sound, consider strategies to reduce reportable assets, such as paying down debt or contributing to retirement accounts (consult with a financial advisor).

- Income vs. Assets: Income is generally weighed more heavily than assets. Focus on minimizing taxable income within legal and ethical boundaries.

Exploring Merit-Based Aid Opportunities

Merit-based aid isn't based on financial need; it's awarded based on academic achievements, talents, or other criteria.

- Research Scholarship Opportunities: Look for scholarships from colleges, universities, private organizations, and even your local community.

- Strengthen Your Application: Focus on improving your grades, test scores, and extracurricular activities to increase your chances of receiving merit-based aid.

- Tailor Applications: Customize your applications to highlight your strengths and achievements that align with the scholarship criteria.

Considering the Cost of Attendance (COA)

The Cost of Attendance (COA) varies significantly between institutions and can significantly influence your overall financial aid needs.

- Compare COAs: Research the COA at different schools you're considering. Include tuition, fees, room and board, books, and other estimated expenses.

- Understand Institutional Aid: Investigate the financial aid packages offered by each institution. Some schools are more generous than others.

- Consider Community Colleges: Start at a community college to save on tuition costs before transferring to a four-year university.

Appealing Your Financial Aid Award

If you believe your financial aid award doesn't accurately reflect your family's financial situation, you have the right to appeal.

- Documenting Special Circumstances: Gather documentation to support your appeal, such as medical bills, job loss, or other significant financial hardships.

- Contact the Financial Aid Office: Schedule a meeting with the financial aid office to discuss your concerns and learn about the appeal process.

- Submit a Formal Appeal: Follow the institution's specific guidelines for submitting a formal appeal, including providing a clear and concise explanation of your situation and supporting documentation.

Can you stack financial aid and scholarships?

Understanding the Concept of "Stacking"

Stacking financial aid and scholarships essentially means combining multiple sources of funding to cover the cost of your education. This can include federal aid (like Pell Grants and student loans), state grants, institutional aid from the college or university, and private scholarships from external organizations. The goal is to reduce the amount you need to pay out of pocket.

- Federal financial aid is often the foundation, with need-based grants like the Pell Grant being a primary source.

- State grants can be added on top of federal aid, providing additional support based on residency and financial need.

- Institutional aid, offered directly by the college, can further supplement federal and state assistance.

- Finally, private scholarships can fill the gaps left after all other aid sources have been applied.

Impact of Scholarship Amounts on Other Aid

While stacking is possible, the amount of scholarships you receive can impact your eligibility for other types of financial aid. Colleges are required to ensure that the total amount of aid you receive does not exceed the cost of attendance (COA).

- Colleges typically adjust need-based aid first if your total aid package surpasses the COA.

- This may involve reducing institutional grants or federal subsidized loans.

- Unsubsidized loans are usually reduced after subsidized loans.

- Pell Grant reductions are less common but can occur in over-award situations.

Institutional Policies and Scholarship Reporting

Each college has its own policies regarding the stacking of financial aid and scholarships. It's essential to understand your school's specific rules to avoid any surprises.

- Many colleges require you to report all external scholarships to their financial aid office.

- The financial aid office will then reassess your aid package to ensure it doesn't exceed the cost of attendance.

- Some colleges have more generous policies than others, allowing you to keep a larger portion of your scholarship money.

- Be sure to ask about scholarship displacement policies, which outline how external scholarships affect institutional aid.

Cost of Attendance Considerations

The cost of attendance (COA) is a crucial factor in determining how much financial aid you can receive. It includes not only tuition and fees but also living expenses, books, supplies, and other educational costs.

- Colleges calculate the COA based on factors like residency, enrollment status (full-time or part-time), and living arrangements (on-campus or off-campus).

- Scholarships can help cover various components of the COA, including tuition, room and board, and even transportation.

- If your scholarships exceed the tuition portion of the COA, they can be used to cover other expenses.

- Understand the COA breakdown at your school to better understand how scholarships can best be utilized.

Strategies for Maximizing Your Aid Package

To maximize your financial aid package, it's important to be proactive and strategic.

- Apply for as many scholarships as possible, even small ones.

- Carefully read the terms and conditions of each scholarship to understand any restrictions or requirements.

- Communicate with your school's financial aid office to discuss your scholarship options and how they will affect your aid package.

- Consider strategies like reducing loan amounts or adjusting your COA budget to accommodate additional scholarship funding.

Frequently asked questions

How do scholarships and FAFSA interact to determine my financial aid package?

Scholarships and FAFSA work together to create a comprehensive financial aid package. FAFSA determines your Expected Family Contribution (EFC), which is the amount your family is expected to pay. Scholarships are then applied to your educational costs, reducing the amount you need in other aid forms like loans. Generally, scholarships reduce your 'unmet need' first, potentially lowering the amount of need-based aid (like grants) you are eligible for, but always benefiting you overall.

What happens if I receive scholarships after submitting my FAFSA?

If you receive scholarships after submitting your FAFSA, you need to notify your financial aid office. The school will then adjust your financial aid package accordingly. Typically, scholarships are used to reduce any remaining unmet need first. After unmet need is met, the amount of loans may be reduced to avoid over-awarding. Some schools may reduce grants, but always aim to ensure you receive the maximum amount of aid possible.

Can I apply for scholarships even if I think my family's income is too high for FAFSA aid?

Yes, absolutely! Many scholarships are merit-based and not based on financial need, meaning eligibility isn't tied to your family's income as determined by FAFSA. Applying for scholarships can significantly reduce your reliance on loans, regardless of your FAFSA results. Focus on scholarships that match your academic achievements, extracurricular activities, or personal background to improve your chances of securing funding for your education.

What strategies can I use to maximize both scholarship opportunities and FAFSA benefits?

To maximize both, start by completing the FAFSA as early as possible. Simultaneously, begin your scholarship search. Prioritize scholarships with deadlines before the FAFSA deadline to better estimate your resources. Look for scholarships offered by your college, as well as external scholarships like those from organizations or foundations. Keep meticulous records of your scholarship applications and FAFSA documentation to ensure a smooth process and avoid missing deadlines, ultimately leading to the maximum possible financial aid.