What to Do If You Receive More Financial Aid Than You Need

Navigating the world of financial aid can be tricky, especially when you receive more funds than anticipated. While extra money might seem like a windfall, it's essential to handle it responsibly to avoid future financial issues. This article will guide you through the steps to take if your financial aid package exceeds your actual needs. We'll cover how to accurately assess your expenses, understand your aid disbursement schedule, and communicate effectively with your financial aid office. Learn how to reduce your loan amounts, return excess funds, and make informed decisions to secure your financial future.

What To Do When Your Financial Aid Exceeds Your Needs

It can be a welcome surprise, but receiving more financial aid than you need requires careful handling. The key is to avoid misusing the funds and ensure you're not penalized later. Excess financial aid typically comes from a combination of grants, scholarships, and loans. The first step is to accurately assess your actual educational expenses. This includes tuition, fees, room and board (if applicable), books, and required supplies. Once you have a clear understanding of your costs, you can determine the extent of the overage and proceed accordingly. It’s essential to communicate with your school's financial aid office as they can guide you through the specific policies and procedures. Failing to address the excess aid can lead to complications, including having to repay funds later or impacting your eligibility for future aid.

Return Unneeded Loan Funds

If a portion of your financial aid package comes in the form of student loans, you have the option to return the unneeded amount. Returning loan funds is often the most advantageous course of action, as it reduces the overall amount you'll need to repay with interest in the future. Contact your loan servicer to initiate the process. Make sure to understand the implications, as some loans may have different return policies. Reducing your loan balance upfront can save you a significant amount of money in interest over the life of the loan.

Reduce or Cancel Future Disbursements

If the excess aid is projected to continue in future semesters or academic years, you can proactively reduce or cancel future disbursements. This involves contacting your school's financial aid office to adjust your aid package. Reducing future aid disbursements is particularly useful for students who anticipate changes in their financial circumstances or enrollment status. This ensures you are not borrowing or accepting aid that you do not need. Communicating your intentions early will help the financial aid office adjust your awards efficiently.

Apply Excess Funds to Other Educational Expenses

While grants and scholarships are typically restricted to direct educational costs like tuition and fees, loan funds can sometimes be applied to other educational expenses. These might include necessary living expenses, transportation, or certain technology requirements for your program. However, be careful to document any expenses that you use loan funds for to ensure compliance with any loan terms. Prioritize direct educational costs, but if permissible, using extra loan funds for other related expenses can help alleviate financial strain. Check with your financial aid office to confirm what expenses are eligible.

Explore Options for Savings or Investments

If you have remaining funds after covering all eligible educational expenses and have reduced or returned excess loan amounts, consider exploring options for savings or investments. You can set aside the extra money for future education-related expenses, such as graduate school or professional development. Opening a high-yield savings account or a low-risk investment account can help the money grow over time. Before making any investment decisions, consult with a financial advisor to ensure your choices align with your financial goals and risk tolerance.

Understand Potential Tax Implications

Be aware that financial aid, especially scholarships and grants, may have tax implications. Some portions of your aid may be considered taxable income if they are used for expenses other than tuition, fees, and required course materials. Understanding the tax rules surrounding financial aid is crucial to avoid surprises during tax season. Consult with a tax professional or refer to the IRS guidelines for more detailed information. Keep accurate records of how your financial aid funds were used to accurately report any taxable income.

| Action | Description | Benefits | Considerations |

|---|---|---|---|

| Return Loan Funds | Return the unneeded portion of student loans to the lender. | Reduces future debt and interest payments. | Check loan servicer's return policies. |

| Reduce Future Disbursements | Adjust your financial aid package with the financial aid office. | Prevents accumulating unnecessary debt. | Requires proactive communication with the school. |

| Apply to Educational Expenses | Use funds for eligible living expenses, transportation, or technology. | Covers broader educational needs. | Must comply with loan terms and document expenses. |

| Save or Invest | Set aside extra funds in savings or low-risk investments. | Allows for future education-related expenses or financial growth. | Consult a financial advisor before investing. |

| Understand Tax Implications | Consult with a tax professional about the taxability of certain aid. | Avoids surprises and ensures compliance with tax laws. | Requires tracking and reporting of how aid was used. |

What if you have extra financial aid money?

Understanding Refund Policies

- Check with your school's financial aid office. They can provide detailed information on how refunds are processed, the timeline for receiving the money, and any restrictions on its use.

- Review your award letter carefully. This document outlines the terms and conditions of your financial aid, including any stipulations regarding excess funds. Some scholarships or grants might have specific spending requirements.

- Inquire about disbursement methods. Refunds are often distributed via direct deposit to your bank account or through a check mailed to your address. Confirm your preferred method with the school.

Eligible Expenses for Financial Aid

- Educational expenses are the primary focus. Financial aid is intended to cover costs directly related to your education, such as textbooks, school supplies, and required equipment.

- Transportation costs can be covered. You can use your extra financial aid money to help with commuting costs to and from school.

- Living expenses are often included. These funds can be used to cover housing, food, utilities, and other basic necessities if you're living off-campus. Remember to budget responsibly to avoid running out of money before the end of the semester or year.

Responsible Spending Strategies

- Create a budget. This will help you track your income and expenses and ensure that you're using the money wisely. Identify your essential needs (rent, food, transportation) and allocate funds accordingly.

- Avoid unnecessary spending. Resist the temptation to use the money on non-essential items, such as entertainment or expensive gadgets. Prioritize your academic and living needs.

- Consider saving a portion of the refund. Building an emergency fund can provide a financial cushion for unexpected expenses. This is especially useful for students who don't have other sources of financial support.

Potential Consequences of Misuse

- Financial aid eligibility can be affected. Spending money on non-approved expenses can jeopardize your future eligibility for financial aid. Schools can audit your spending and require you to repay misused funds.

- Tax implications may arise. In some cases, spending financial aid on non-qualified expenses can result in taxable income. Consult with a tax advisor to understand your obligations.

- Academic performance can suffer. If you misuse your financial aid and run out of money before the end of the semester, you may have difficulty affording textbooks, transportation, or housing, which can negatively impact your academic performance.

Long-Term Financial Planning

- Develop good financial habits early. Learning to manage your money responsibly while in college will benefit you throughout your life. Create a budget, track your expenses, and avoid unnecessary debt.

- Consider student loan repayment options. If you have student loans, research different repayment plans and strategies to minimize your debt burden after graduation.

- Seek financial advice. If you're unsure about how to manage your financial aid or plan for the future, consult with a financial advisor or your school's financial aid office. They can provide personalized guidance based on your specific situation.

What happens if financial aid overpays you?

Notification of Overpayment

The first thing that typically happens is that you will receive a notification of overpayment from the school's financial aid office or the agency that provided the aid. This notification will detail the amount of the overpayment, the reason for it, and instructions on how to resolve the issue. It's crucial to read this notice carefully and respond promptly. Failure to acknowledge the overpayment will typically lead to additional actions.

- Review the notification immediately.

- Contact the financial aid office with any questions.

- Document all communication and keep records.

Reasons for Overpayment

Several reasons can cause financial aid overpayments. Common causes include changes in enrollment status (e.g., dropping courses), receiving external scholarships or grants that were not initially factored into your aid package, or errors in the calculation of your eligibility. It's important to understand why the overpayment occurred to prevent similar issues in the future. You may need to adjust your budget or course load accordingly.

- Changes in enrollment, such as dropping classes.

- Receipt of external scholarships or grants not initially reported.

- Errors in calculation of eligibility for aid.

Repayment Options

Typically, you will be given several options for repaying the overpayment. The most common method is to return the funds directly to the school or lending agency. In some cases, the overpayment can be deducted from future financial aid disbursements. A payment plan might also be available if you cannot repay the full amount immediately. The repayment terms will be clearly outlined in the notification you receive.

- Directly returning the funds to the school or agency.

- Deduction from future financial aid disbursements.

- Establishing a payment plan if you cannot repay immediately.

Consequences of Non-Repayment

Failure to repay a financial aid overpayment can lead to severe consequences. The school may place a hold on your academic records, preventing you from registering for future courses or obtaining your transcript. You may also be ineligible for further financial aid until the overpayment is resolved. Additionally, the overpayment could be reported to credit bureaus, negatively affecting your credit score. In some cases, the debt could be sent to a collection agency, leading to further legal action.

- A hold on academic records.

- Ineligibility for future financial aid.

- Negative impact on your credit score.

Appealing the Overpayment

If you believe the overpayment is an error or that you have extenuating circumstances, you may have the option to appeal. The appeal process usually involves submitting documentation to support your case, such as proof of income changes or an explanation of why you dropped courses. It's crucial to follow the appeal instructions carefully and provide all required information. The financial aid office will review your appeal and make a decision. The decision is not always guaranteed to be in your favor, but it is worth pursuing if you have valid grounds.

- Submitting documentation to support your case.

- Following the appeal instructions precisely.

- Understanding that the appeal outcome is not guaranteed.

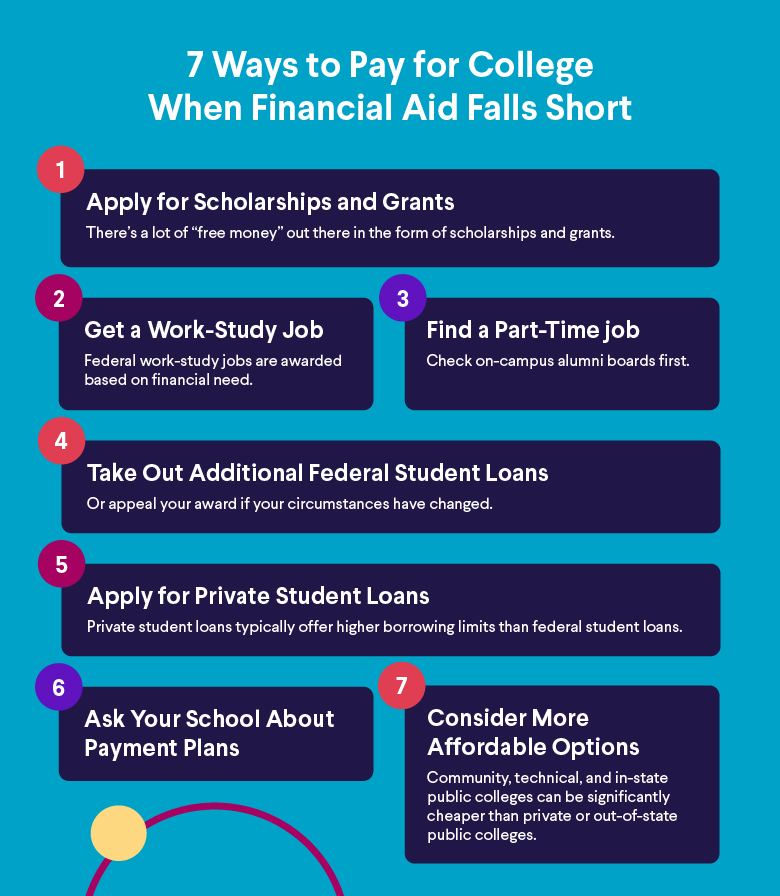

What to do if you maxed out financial aid?

Explore Private Student Loans

Private student loans can be a viable option, but they should be approached with caution. They often come with higher interest rates and less flexible repayment terms compared to federal loans. Before taking out a private loan, thoroughly research different lenders and compare their interest rates, fees, and repayment options. Consider both fixed and variable interest rates and understand the long-term implications of each. Look for lenders offering features like cosigner release options or interest rate discounts.

- Shop around for the best rates and terms: Don't settle for the first offer you receive.

- Consider a cosigner: A creditworthy cosigner can help you secure a lower interest rate.

- Understand the repayment terms: Be aware of the repayment schedule, grace periods, and any potential penalties for late payments.

Increase Your Income

Increasing your income is a proactive way to reduce your reliance on financial aid. This could involve taking on a part-time job, working during school breaks, or exploring freelance opportunities. Seek out on-campus jobs as they often offer flexible hours and may be understanding of your academic schedule. Explore internships related to your field of study; these can provide both income and valuable work experience. Consider using skills you already have to offer services online or in your community.

- Look for on-campus employment: Often more convenient and understanding of student needs.

- Explore part-time jobs in your field of study: Gain experience while earning income.

- Freelance or offer services based on your skills: Utilize existing talents to generate income.

Reduce Your Expenses

Carefully evaluate your spending habits and identify areas where you can cut back. This might involve finding cheaper housing options, reducing spending on entertainment, or buying used textbooks. Consider living with roommates to split rent and utility costs. Take advantage of student discounts offered by local businesses and online retailers. Cook your own meals instead of eating out, and explore free or low-cost activities on campus and in the community.

- Find cheaper housing options: Consider living with roommates or in a more affordable area.

- Reduce spending on non-essential items: Cut back on entertainment, eating out, and unnecessary purchases.

- Buy used textbooks and materials: Save money by purchasing used books and other school supplies.

Explore Scholarships and Grants (Even After Starting School)

While you may have already applied for scholarships and grants before starting school, it's important to continue searching for them throughout your academic career. Many organizations offer scholarships with rolling deadlines or specific eligibility requirements that you might now meet. Check with your department, university, and professional organizations for scholarships specific to your field of study. Utilize online scholarship search engines and be diligent in applying for every opportunity you qualify for.

- Continuously search for new scholarships and grants: New opportunities arise frequently.

- Check with your department and university for specific scholarships: They may have scholarships specifically for your major.

- Utilize online scholarship search engines: Filter your search based on your qualifications.

Consider a Gap Year or Semester

Taking a break from your studies to work and save money can be a difficult decision, but it can be a financially responsible one. A gap year or semester provides an opportunity to earn income and reduce the amount of borrowing required to complete your education. This time can also be used to reassess your academic goals and ensure you are pursuing the right path. Explore opportunities for internships or volunteer work related to your field of interest to gain valuable experience during your break.

- Work and save money to reduce future borrowing: A temporary break can provide financial stability.

- Reassess your academic goals and career path: Ensure you are on the right track.

- Gain valuable work experience through internships or volunteer work: Enhance your resume and skills.

What happens if your financial aid is more than your tuition?

What Happens to the Excess Funds?

The most common outcome is that you will receive the remaining financial aid as a refund. This refund is intended to help you pay for other eligible education expenses, such as books, supplies, room and board, and transportation. The school's financial aid office will typically notify you about the refund process and the available disbursement options.

Disbursement Methods and Timelines

Schools usually offer several ways to receive your financial aid refund. The most common options are:

- Direct Deposit: The funds are electronically transferred to your bank account. This is generally the fastest and most convenient method.

- Check: A paper check is mailed to your address. This method may take longer than direct deposit.

- School-issued debit card: Some schools partner with financial institutions to provide debit cards for receiving refunds.

The timing of the disbursement depends on your school's schedule and when the financial aid funds are received. Check with your financial aid office for specific timelines.

Using the Refund Wisely

It's crucial to use your financial aid refund responsibly. While it might be tempting to spend it on non-essential items, remember that the funds are intended to cover educational expenses. Consider using the money for:

- Textbooks and Course Materials: These can be expensive, so prioritize purchasing them.

- Room and Board: If you live off-campus, use the refund to cover rent and utilities. If you live on-campus, the refund can help with meal plans and other living expenses.

- Transportation: Use the funds for commuting costs, such as gas, public transportation, or car repairs.

- Other Educational Expenses: This includes software, equipment, or other supplies required for your courses.

Potential Tax Implications

It is essential to understand that some portions of your financial aid may be considered taxable income. This is especially true for the portion of your financial aid refund that is used for room and board if you're not required to live on campus. Consult IRS Publication 970, Tax Benefits for Education, or a tax professional for detailed information and guidance. Keep accurate records of how you spend your financial aid refund to make tax preparation easier.

Returning Excess Funds

In some situations, you may choose to return a portion of your financial aid if you don't need the full amount. This can be a good option if you want to reduce your overall student loan debt or avoid potential tax implications. The process for returning funds typically involves contacting your school's financial aid office and following their instructions. Note that returning funds may affect your future financial aid eligibility.

Frequently asked questions

What happens if I receive more financial aid than my college expenses?

Excess financial aid is typically refunded to you by your school. This refund can be used for educational expenses that aren't directly billed by the university, such as books, supplies, transportation, or living expenses. It's crucial to track your spending to ensure the refund is used for legitimate educational purposes.

What are my options if I don't need all the financial aid I received?

You have several options: you can return the excess aid, typically starting with unsubsidized loans to reduce your overall debt. Alternatively, you can save the excess funds in a high-yield savings account for future educational expenses or emergency situations. Also, check with your financial aid office about potentially reducing the amount of your aid package for future semesters.

Will receiving too much financial aid affect my future eligibility?

Receiving excess financial aid generally doesn't impact your future eligibility as long as the funds are used for educational expenses. However, failing to report changes in your financial situation that result in you receiving more aid than you need could potentially affect your eligibility. It's important to accurately report income and expenses on the FAFSA and notify your financial aid office of any changes.

How do I return excess financial aid?

Contact your school's financial aid office immediately to inform them of the excess funds. They will provide you with specific instructions on how to return the money. This usually involves writing a check to the school or electronically transferring the funds back. Prioritize returning loan funds to reduce your debt burden and interest accrual.